How Owning A Home Protects You From Inflation

Rising inflation can have a significant impact on your personal finances. When your paycheck doesn’t go as far this month as it did last month, your budget can start to feel the crunch.

With inflation now reaching levels not seen in 40 years (up to 7.9% percent in February), real estate is becoming even more attractive as an investment option.

If you’re a homeowner, there are several ways you are protected against the impact of inflation. And if you have a mortgage, not only are you protected but you can actually BENEFIT from its impact.

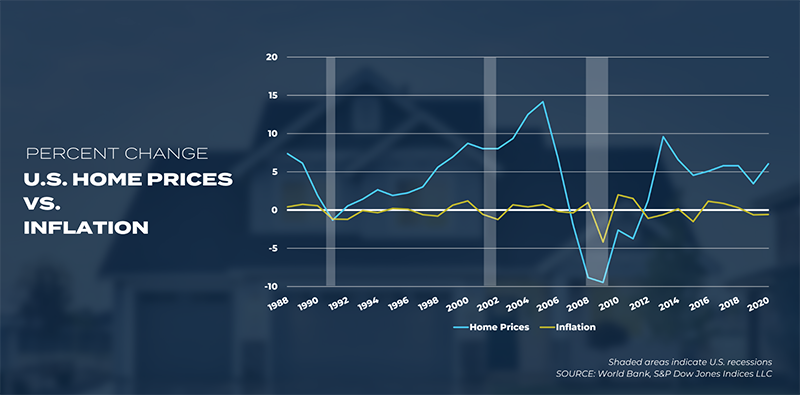

Real Estate A Hedge Against Inflation

One way to make sure long periods of inflation don’t have a significant impact on your personal finances is to invest in assets that are considered “hedges”.

Basically, a hedge is a “just in case” — something that moves opposite to the market, or at least isn’t subject to wild fluctuations.

For investors, hedging is considered part of a healthy portfolio because it can minimize losses if the market takes big swings in reaction to events like inflation.

Real estate is one of these investments. As the price of a home rises over time, it lowers the loan-to-value of any mortgage debt. As a result, the equity on the property increases, but the fixed-rate mortgage payment remains the same. And if the rate of appreciation exceeds the rate of inflation, it adds an extra layer of security.

Those renting a home do not have that kind of protection. Inflation benefits landlords who earn income from their rental properties, because higher home prices often equal higher rent.

In times of inflation, those who own rental properties can increase the rent they charge while keeping their mortgage the same, putting money in their pocket to compensate for higher prices in the market.

Inflation = Cash for Mortgage Borrowers

Not only does inflation benefit those who own real estate in general, it also REALLY helps those who have mortgages.

Why? Because inflation lowers the real value of debt over time.

For example, say you have a $300,000 mortgage and make interest-only payments for the next 30 years. After that 30 years, you would still owe $300,000 because you have not paid anything toward principal.

However, if you take into account the impact of inflation you’ll see that’s not really the case.

While you still owe the same amount in “nominal” terms (meaning actual dollars), your $300,000 of mortgage debt in “real” terms (or the actual value of that money) would only be $136,425 if inflation averaged 3% per year over those 30 years.

Essentially, you were able to cut the real value of your debt in half without making any payments against the principal of your mortgage. Inflation did all the work for you.

What’s more, if the rate of inflation exceeds the interest rate of your mortgage, your lender is effectively paying YOU to borrow money!

In short, inflation is generally good news for borrowers, especially those with mortgages. You can repay the loan in increasingly cheaper dollars, which lowers the cost of borrowing.

Bottom Line

Buying real estate now — despite a hot and competitive market — is a solid bet given that mortgage rates are still low. Not only will you benefit from a fixed housing payment while rents continue to increase, you will also save money in the long term because you will be able to repay your loan in increasingly cheaper dollars.

Want to learn more? Please schedule a call today!

Thinking of buying a home? Learn more about the home buying and mortgage process. Most importantly, get tips on how to avoid pitfalls and guarantee a smooth experience.

WHAT ARE CUSTOMERS ARE SAYING

PROMISE HOME LOANS

NMLS #: 2372318