Rent Is Rising – Achieve Stability As A Homeowner

If you’re a renter feeling hopeless with increasing rent prices, now may be the time to consider homeownership. Data from realtor.com shows that median rent is up 8.1% this year from last, an additional $118 per month for renters in some cities.

Stop worrying about where your rent will be and lock in your monthly housing payment as a homeowner!

Here are three ways renting could be costing you MORE than homeownership.

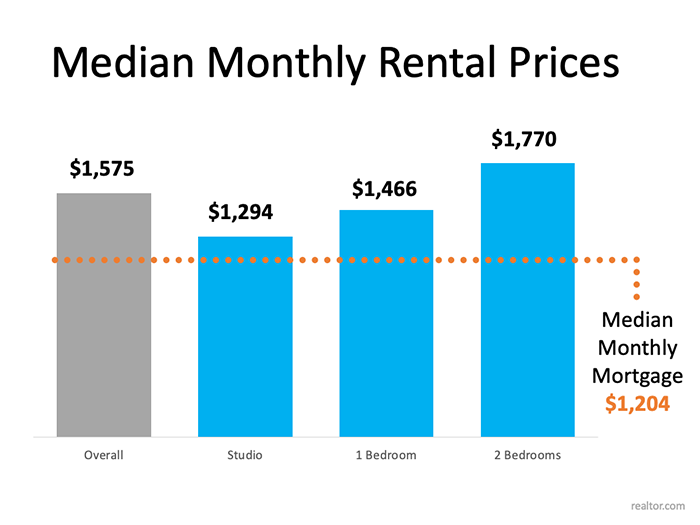

Monthly Mortgage Payments Are Less Than Rent

The National Association of Realtors indicates the latest data on homes closed shows the median monthly mortgage payment is $1,204. By comparison, data from realtor.com shows that the median national rent is $1,575.

On average, recent homebuyers are paying $371 less than renters!

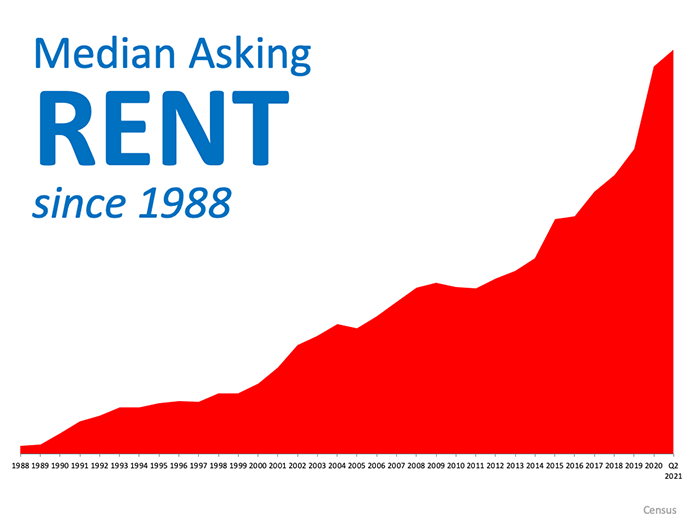

Rent Is Rising Rapidly

Data from the U.S. Census Bureau shows that rent has more than doubled in the past 20 years. The graph below illustrates the steady rise of the median asking rent price since 1988.

Homeowners can lock in their monthly mortgage rate and have a consistent payment over that time.

Benefit From Home Price Appreciation

Not only are rents on the rise, but home prices are too. When your rent goes up, you only benefit your landlord. When home prices go up, homeowners can build their wealth without trying! CoreLogic’s recent Homeowner Equity Insights Report shows that the average equity gain of mortgaged homes during the past year is $33,400!

Bottom Line

Rent will continue rising along with home prices. Make the jump to homeownership now, lock in your monthly payment, and start building your wealth and equity.

Want to learn more? Please schedule a call today!

Thinking of buying a home? Learn more about the home buying and mortgage process. Most importantly, get tips on how to avoid pitfalls and guarantee a smooth experience.

WHAT ARE CUSTOMERS ARE SAYING

PROMISE HOME LOANS

NMLS #: 2372318