When Your Home Builds Wealth, Why Rent?

Rents across the nation are increasing at an alarming rate.

One-bedroom rent has gone up 10.7% and two-bedrooms are even higher at 13.1% according to the Zumper National Rent Report.

Their report further shows that rents have been hitting new all-time highs almost every month in 2021. One-bedroom rent was higher every month except April this year. Two-bedroom rent has consistently increased since February 2021.

These prices show no signs of slowing down either. Apartment List shows that vacancy rates are down to 3.9% this September. A much tighter supply than the usual 6% rate recorded pre-pandemic. Low vacancy rates will lead to fierce competition between apartment hunters and drive up prices.

If you’re renting, these increases are only benefitting your landlord. It’s a different story for homeowners. Yes, home prices are rising too, but over time these increases will build your wealth due to equity. Research from the National Association of Realtors further proves this point,

“Homeownership is a key pathway to building wealth and narrowing the racial income and wealth inequality gap. Housing wealth (equity) accumulation takes time and is built up by price appreciation and paying off the mortgage.”

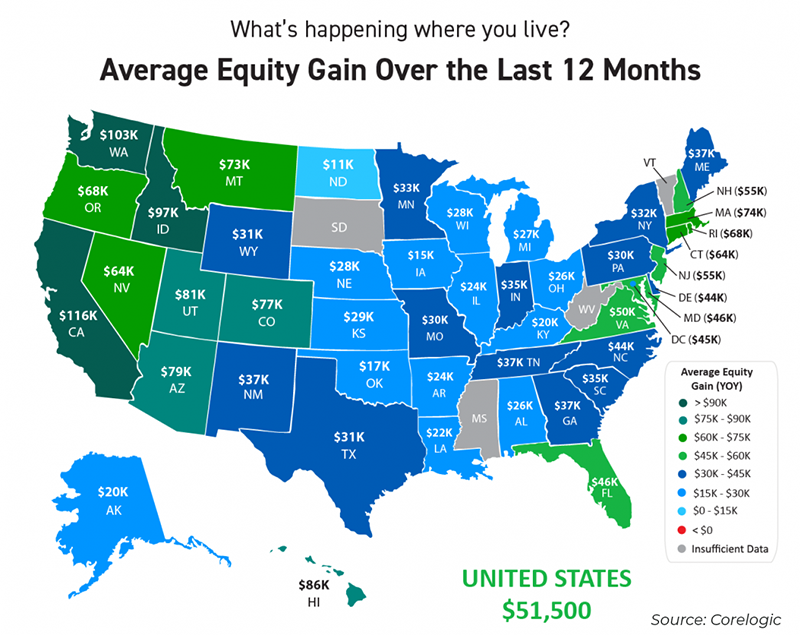

Data below from Corelogic shows how much money the average homeowner made the past year just from making their monthly mortgage payments.

The average homeowner has gained $51,500 in equity over the past 12 months! Home prices aren’t expected to rise this quickly in the next few years, but there’s still a lot of wealth and equity to be gained in a home purchase today.

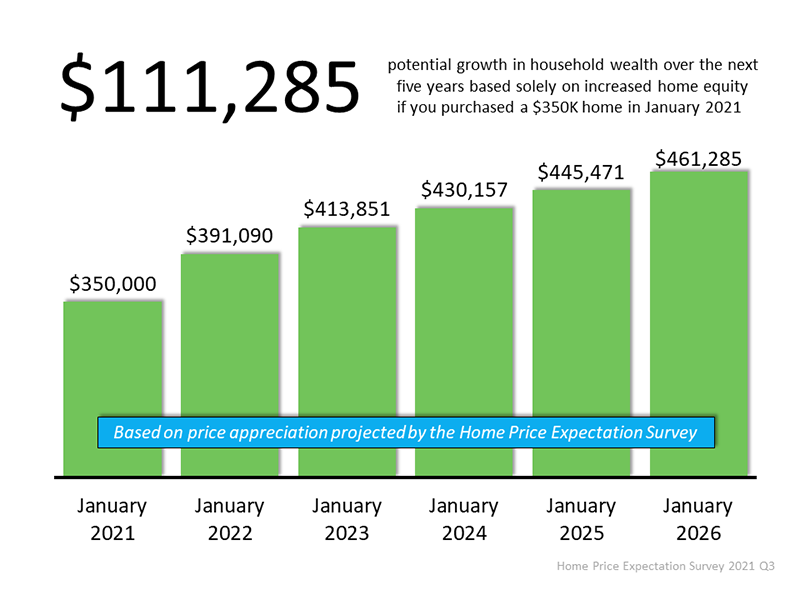

Over one hundred economists, real estate experts, and market strategists put together their most recent Home Price Expectation Survey. They predict home values (which reflects equity) to continue appreciating for the next few years. Their expected price increases were applied to a $350,000 home to create the chart below.

That’s a possible $111,285 of equity to be gained over the next five years!

How Are Principal And Interest Payments Calculated?

Although your total principal and interest payment will be the same each month, the principal and interest distributions change over time as your loan amount gets paid down. Your amortization schedule is the breakdown of how principal and interest is applied to your loan each month for the duration of your loan term.

For example, let’s say you have a $320,000, 30-year mortgage loan with a fixed interest rate of 5%. Your total principal and interest payment is $1,718 every month (for this example we are excluding any taxes and insurance).

For your first payment, $384.50 will go toward principal and $1,333.33 will go toward interest. Your original loan amount of $320,000 is now reduced to $319,615.50 after this first principal payment is applied.

For your second payment, you’ll still be paying $1,718 for principal and interest. However, your distribution is now based on the loan amount of $319,615.50 instead of $320,000. This means more of the monthly payment goes to paying down principal and less to interest.

This continues month after month until you reach a $0 balance on your loan. This helps explain how your P&I payments are applied to your loan. You’ll see this information on your monthly statement as well.

There are many amortization schedule calculators available for you to calculate your own scenarios.

Bottom Line

With rents and home prices on the rise, why not take advantage of homeownership? You can keep a consistent monthly payment and directly benefit from home price appreciation.

Want to learn more? Please schedule a call today!

Thinking of buying a home? Learn more about the home buying and mortgage process. Most importantly, get tips on how to avoid pitfalls and guarantee a smooth experience.

WHAT ARE CUSTOMERS ARE SAYING

PROMISE HOME LOANS

NMLS #: 2372318