Will The Housing Market Crash?

Afraid of overspending on a home and seeing the housing market crash? Data from today’s market and the one that crashed in the early 2000s shows we are NOT in another bubble about to pop. Industry experts predict home prices will continue to rise and that strong demand isn’t going anywhere making now a solid time to begin your journey to homeownership.

Higher Standards Reduce the Risk of a Crash

One reason why the housing market crashed in the early 2000s is lending standards were much more lenient. Today’s market is much better in that regard as Peter Coy of Bloomberg Businessweek states,

“An index of mortgage credit availability reached almost 870 in June 2006. This March it was just 125. Lenders have raised lending standards even beyond the requirements of the Dodd-Frank Act of 2010, which was passed in response to the financial crisis.”

Today’s lower scores indicate stricter standards for borrowers. For you, this just means you need to make sure you are qualified for the right type of loan for your unique situation. Nathaniel Karp, Chief U.S. Economist at BBVA, agrees that these stronger standards indicate a healthy market,

“The housing market is in line with fundamentals as interest rates are attractive and incomes are high due to fiscal stimulus, making debt servicing relatively affordable and allowing buyers to qualify for larger mortgages. Underwriting standards are still strong, so there is little risk of a bubble developing.”

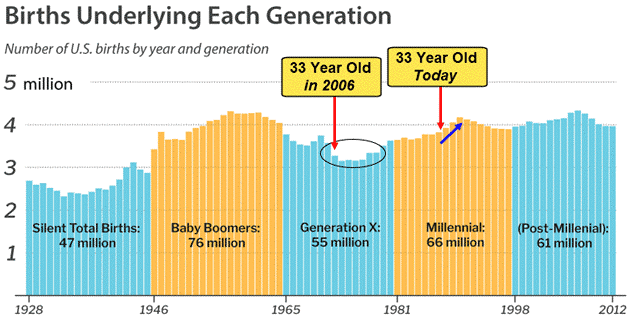

Strong Demand Will Continue

As the pandemic winds down, we may begin to see some relief to the housing shortage. New home construction has been booming and buyers have been more willing to let people into their homes. Even with those expected improvements, it will still be years before inventory catches up with demand. Millennials, one of the biggest generations since the baby boomers, are entering home-buying age in large numbers.

Bill McBride of Calculated Risk, who states he worried about a crash in 2005, says the millennial generation’s strong desire for homeownership doesn’t give him the same anxiety he felt back then,

“Because all of the fundamentals are there. Demand will be high for a while because Millennials need houses. Prices will keep rising for a while because inventory is so low.”

A research note from Goldman Sachs shows they also agree that millennials entering home-buying age and other factors will continue to push the market forward,

“Strong demand for housing looks sustainable. Even before the pandemic, demographic tailwinds and historically-low mortgage rates had pushed demand to high levels. … consumer surveys indicate that household buying intentions are now the highest in 20 years. … As a result, the model projects double-digit price gains both this year and next.”

Many experts agree that today’s market is simply a case of low supply and high demand. You can remain confident in a home purchase this year with demand expected to stay strong for years and strict borrowing practices keeping everything in check.

How YOU Can Compete in this Crazy Market

With today’s low rates and home prices expected to continue rising, you’ll want to lock in your new home purchase as soon as possible. If you are ready to start making offers, go through a complete underwriting process with NEO Home Loans before you go shopping. This will ensure a faster transition to your new home. If you are looking to upgrade from your current home, ask about our Trade Up program. It will allow you to submit an all-cash offer, even if you don’t have it.

Want to learn more? Please schedule a call today!

Thinking of buying a home? Learn more about the home buying and mortgage process. Most importantly, get tips on how to avoid pitfalls and guarantee a smooth experience.

WHAT ARE CUSTOMERS ARE SAYING

PROMISE HOME LOANS

NMLS #: 2372318