Beware Fake News On Housing – Slowing Does NOT Equal Crashing

Be on the lookout for fake real estate news!

The amount of misinformation about the real estate market reached new levels this week. There have been reports that 48% of home prices are being reduced, and that higher interest rates are completely tanking the market (even though mortgage rates have actually DECREASED since the Fed raised the fed funds rate again last week).

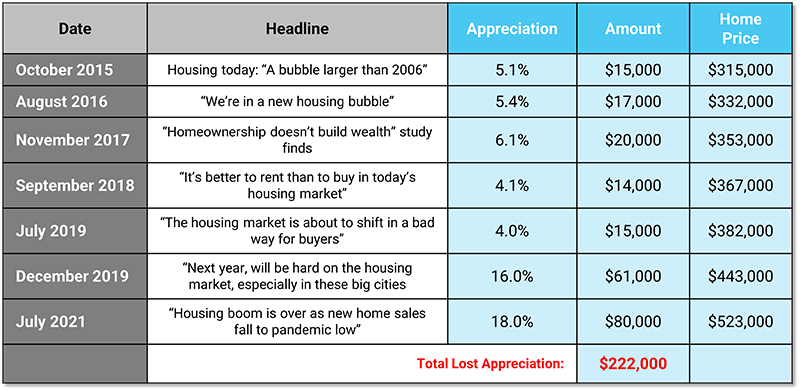

Fake news about the housing market is not new. Check out the table below showing some of the common headlines in the news over the last few years compared what actually happened in the market as far as home prices and appreciation.

As you can see, despite media warnings about the health of the housing market, home values have consistently appreciated since 2015 and howeowners have seen incredible gains in equity.

If you had followed the advice of these media outlets and stayed out of the housing market, you would have lost out on $222,000 in equity in the last 7 years alone. That’s $222,000 of tax-free income wasted!

New Housing Reports Do Not Tell The Full Story

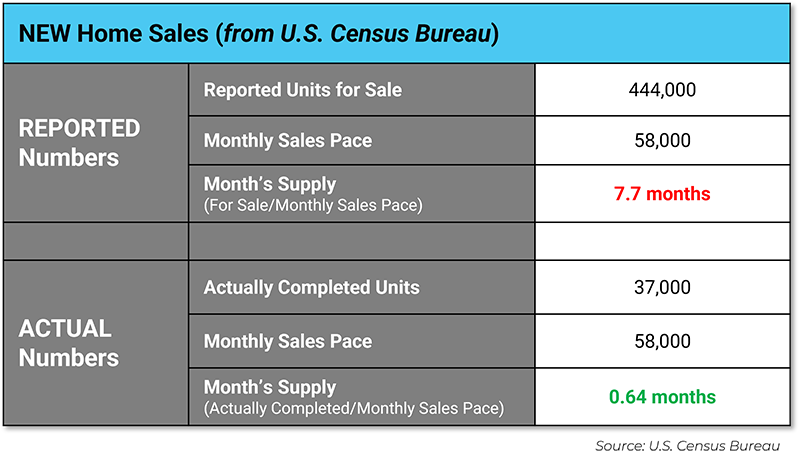

Unfortunately, there’s more misinformation circulating today following the release of the Monthly Residential Sales Report from the U.S. Census Bureau for May 2022. Let’s dive into some of the reported numbers to get some perspective on what’s actually happening in the market.

The Census report shows that there were 444,000 new homes on the market at the end of last month, and that the number of new homes sales jumped to an annualized rate of 696,000, which gives us a monthly sales pace of 58,000.

If you take these numbers at face value without digging deeper, they show that we have a 7.7-month supply of homes on the market right now – a staggering increase from what we’ve seen over the last two years.

The media is taking these numbers and running, spinning Americans into a frenzy with warnings that the housing market is trending downward and that home prices are bound to drop in the near future.

But the numbers do not tell the whole story. If you dive deeper into the report, you will see that there were actually only 37,00 completed homes on the market at the end of last month. Divide that by the monthly sales pace, and we are looking at a true home supply of only .64 months on the market right now. The rest of the homes are still being built and are not finished units.

The story is similar for existing home sales:

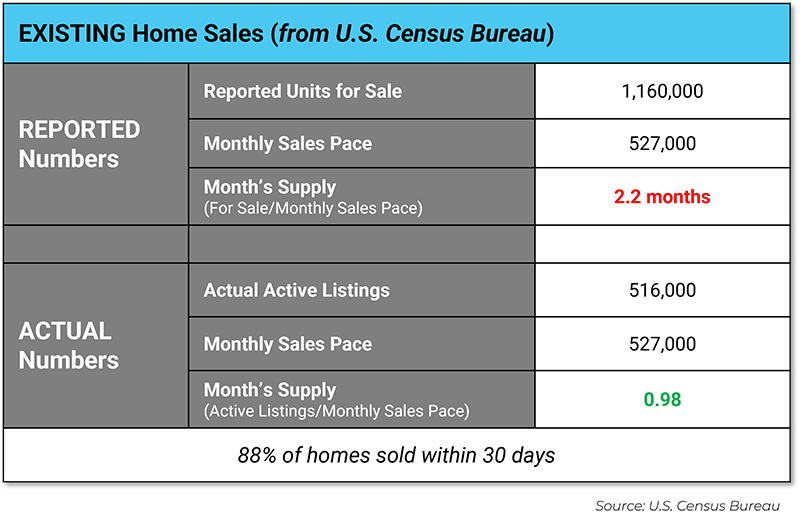

It’s being reported that there are 1.16M homes for sale across the country with a monthly sales pace of 527,000, giving us a 2.2-month supply of existing homes on the market. Even this number is dangerously low because of the 130M households across the country.

But again, the numbers don’t paint the full picture. Of the reported existing homes for sale, only 516,000 of them are actual active listings. The rest already have a buyer and are under contract to close. This means the true supply of existing homes on the market is currently at only .98 months – and they are selling fast! 88% of homes today are being sold within 30 days.

Bottom Line

Interest rates are set by the market and do not vary widely from lender to lender. If you find a lender who is advertising a drastically lower interest rate than the competition, be wary and look at the fine print – it is highly likely they are asking for points to be paid and near-perfect credit and income qualifications.

Want to learn more? Please schedule a call today!

Thinking of buying a home? Learn more about the home buying and mortgage process. Most importantly, get tips on how to avoid pitfalls and guarantee a smooth experience.

WHAT ARE CUSTOMERS ARE SAYING

PROMISE HOME LOANS

NMLS #: 2372318